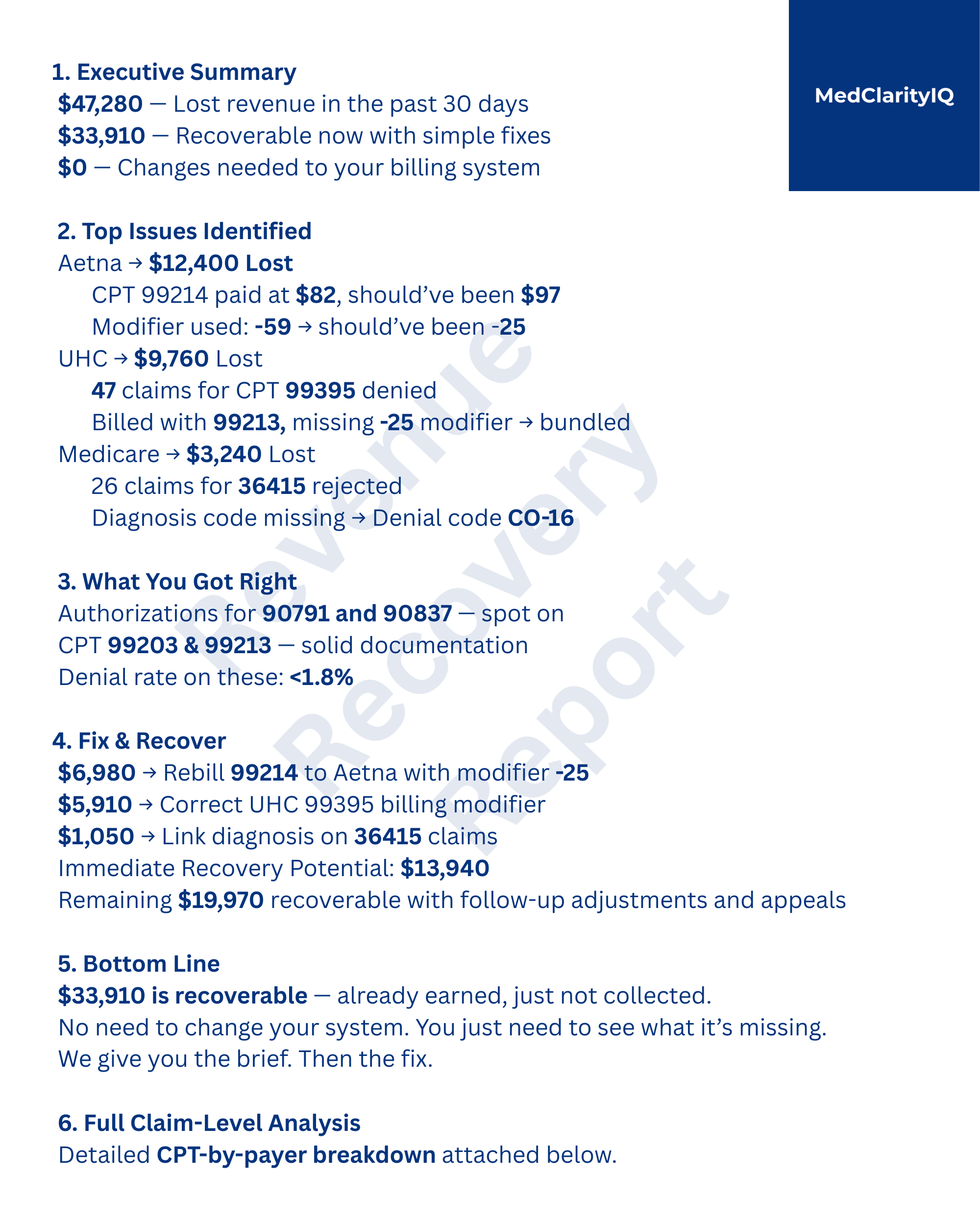

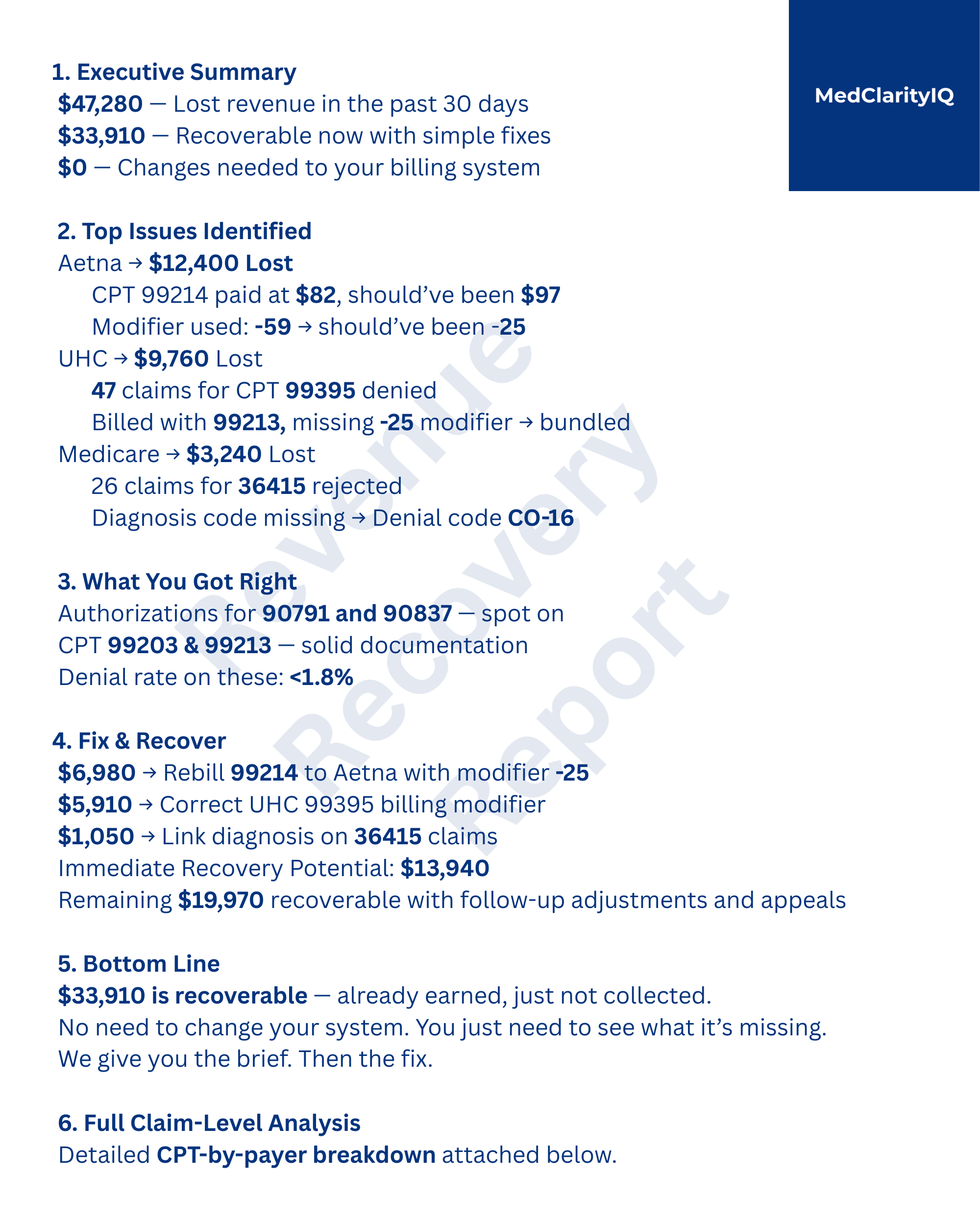

What if every month, you had an simple Actionable-Brief that told you this…

👉 How much revenue your clinic lost

👉 Why it happened

👉 And how to fix it — claim by claim

And it was completely free? Sounds good, right?

👉 How much revenue your clinic lost

👉 Why it happened

👉 And how to fix it — claim by claim

And it was completely free? Sounds good, right?

They thought they were being paid fairly — until we showed them Aetna and UHC were silently shortpaying for months. Their billing team never saw it coming.